Best Investment Options for Smart Investors

Banks and companies offer fixed deposits with varying interest rates and lock-in periods. All an investor has to do is find the right FD scheme and pick the ideal tenure to earn returns. Of late, the interest earnings from FDs have become much lower than earlier due to a reduction in the interest rates. However, they still remain one of the most preferred and safe investment options for investors of all ages.

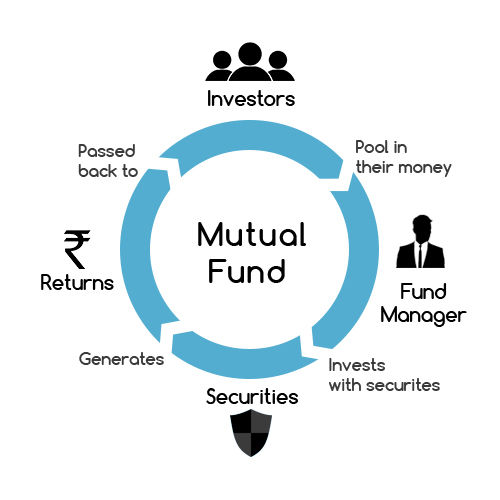

PPFs are similar to mutual funds in the sense that they comprise of pooled funds. These funds are basically investments made by investors to earn returns at the rate of 8.1% per annum which is tax-free.